bbk is minimal R client for the following APIs:

In the future, it may be extended to other central banks and financial institutions. Feel free to open an issue if you have a specific request.

You can install the released version of bbk from CRAN with:

install.packages("bbk")And the development version from GitHub with:

# install.packages("pak")

pak::pak("m-muecke/bbk")bbk functions are prefixed according to the central bank they access

(bbk_, ecb_, snb_,

boe_, bde_, bdf_,

onb_, boc_) and follow the naming conventions

of their respective APIs.

The typical workflow involves:

library(bbk)

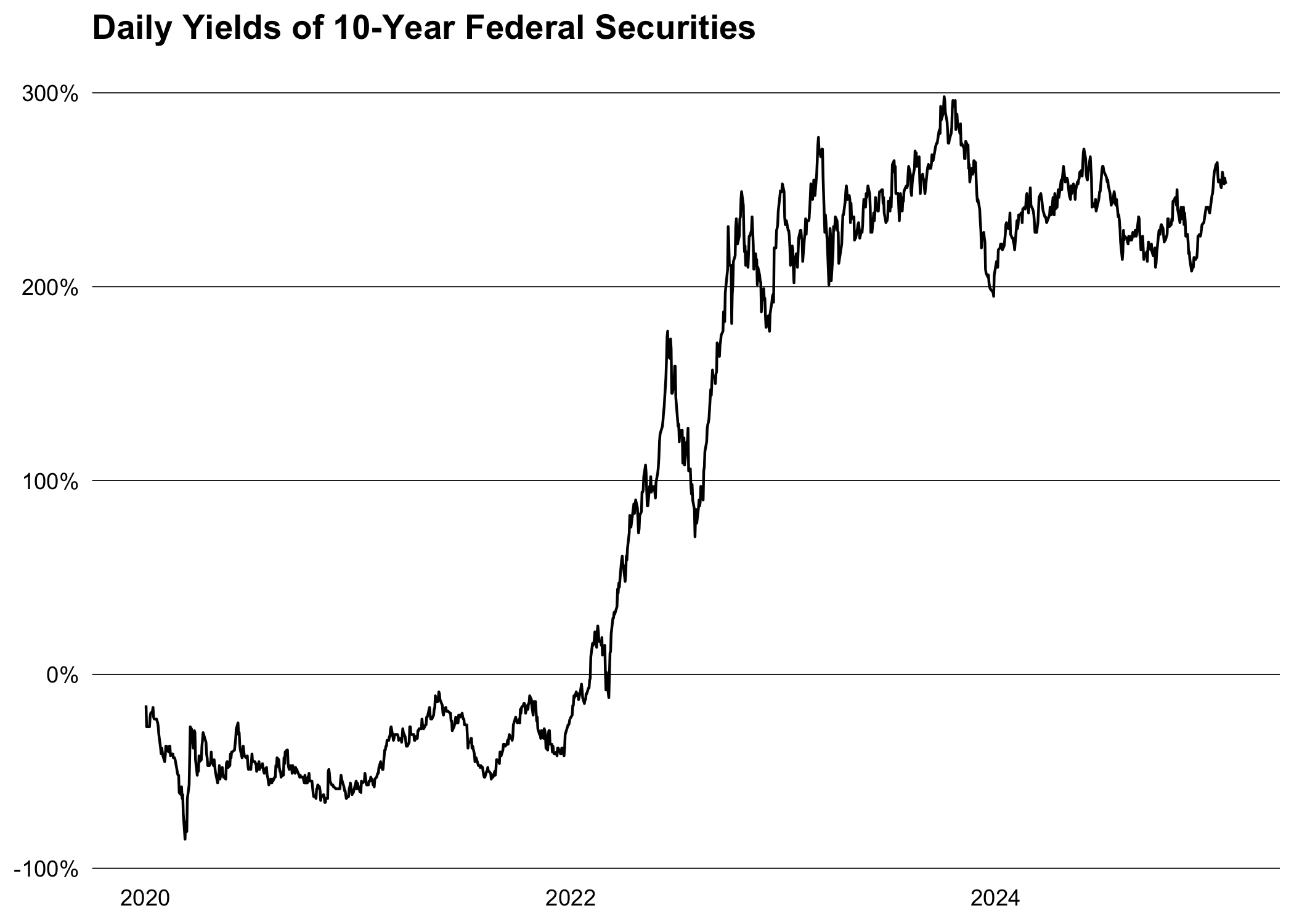

# Deutsche Bundesbank - fetch 10 year daily yield curve

yield_curve <- bbk_data(

flow = "BBSIS",

key = "D.I.ZAR.ZI.EUR.S1311.B.A604.R10XX.R.A.A._Z._Z.A",

start_period = "2020-01-01"

)